Is motor comprehensive insurance comprehensive?

You might assume that buying a comprehensive insurance policy to cover your vehicle means there will be no out-of-pocket expenses. Sadly, you are misguided. There are terms, limitations, exclusions and conditions within the policy that will decide your final claim amount or no claim amount paid.

The first motor car to appear on a British road was Benz in 1894. According to law, the vehicle was not to operate on a public road with a speed exceeding 5km per hour. A man has to carry a red flag and walk in front of the car. In 1896 the law was changed. They could now travel 20km per hour. There were many accidents involving damage to property and injury to people. Often the person responsible for the accident had no insurance. They also did not have enough money to settle the claim.

Motor insurance was available from around 1898 and 1903. Motor vehicles appeared in larger numbers on road after the First World War. In 1909 there were less than 100,000.00 vehicles in Britain. In 1919 there were 330,000.00 vehicles. In 1929 there were 2,130,000.00. By 1929, over 6000 people were killed annually in road accidents.

Many accident victims and their dependents were unable to recover damages because the motorist concerned with the accident was uninsured. To protect accident victims, many countries acted by making third-party liability insurance compulsory. Norway was the first country in 1912. Followed by Swiss in 1914, Denmark in 1917, Massachusetts in 1927

New Zealand and Sweden in 1929. In the UK, the road traffic act 1930 made it compulsory to have insurance to cover personal injury to third parties other than passengers carried free of charge. There was an amendment in 1972 which included this exemption.

In Ghana, the Act that makes motor insurance compulsory is the Motor Third Party risk Act, Act 1958. This made it compulsory for vehicle owners to have the Act cover in place to protect injury and death and property damage to third party victims before they put their vehicles on road. The following are a few of the things you need to know about your motor insurance. The third-party motor insurance cover which is compulsory does not cover damage to your vehicle itself. The third-party motor insurance covers the following:

- death of or bodily injury to any person, and/or

- damage to property belonging to someone other than you or a member of your household.

- All legal costs and expenses incurred with the written consent of the insurer in defending any court proceedings arising from an event for which cover is provided are recoverable under this policy.

- Emergency Medical Expenses/Treatment

- Personal Accident Benefit to Policyholder/Driver

Most people were interested in extending the scope of cover to include their vehicles. This brought the development of the comprehensive policy. I have met several people who want to do comprehensive motor insurance because they do not want to incur any cost at the time of claim. This should be the peace of mind and security insurance seek to provide. Is this assertion true? Does motor comprehensive insurance mean everything is covered? But if everything is not covered, can insurers design something to cover everything? What are some of the things that are not covered so clients could make other provisions in case of a loss?

From the Oxford dictionary, the word comprehensive means including or dealing with all or nearly all elements or aspects of something. The motor comprehensive policy covers in addition to the third party and personal accident YOUR VEHICLE. The motor comprehensive policy would pay;

- For loss of or damage to your vehicle and/or accessories caused by or arising out of Accidental Collision or Overturning or Collision or Overturning due to mechanical breakdown or wear and tear.

- Fire external explosion self-ignition or lightning.

- Theft, Burglary, Housebreaking.

- Malicious Act.

- Flood, Typhoon, Hurricane, Volcanic Eruption, Earthquake or other Convulsion of Nature, Strike, Riot, Civil Commotion.

- Or whilst in transit (including the process of loading and unloading incidental to such transit) by road, rail inland waterway, lift or elevator.

- For the loss of or damage to permanently fitted car radio/cassette, compact disk, audio speakers up to the amount specified in the schedule.

The big question is, can we think of other perils (anything that can give rise to a loss) that are not covered in the motor comprehensive policy? Below are few instances an insurance company might repudiate or will not pay for your loss;

- If the insured or any other person, with the knowledge and consent of the insured, is driving the car under the influence of alcohol or drugs or any other intoxicating substance.

- If the vehicle was being driven by a person without a valid driving license.

- Damage to the engine as a result of oil leakage.

- In case of violation of car manufacturer’s guidelines for use of a car and related failures or breakages.

- Gradual wear and tear

- Any damage to the car due to war, terror attacks, invasion of foreign enemy action, civil war, mutiny, rebellion, hostilities, radiation or nuclear material/weapons are not covered under a standard motor policy.

- Deliberate accidental loss, which is a loss arising out of an accident or event that was deliberate is also not covered.

Kindly let us consider some of the following situations. People normally think insurance is deception. Because most claimants have to pay some money after a loss even though they took a comprehensive policy to cover their vehicle. The amount one could pay at the time of loss to have your vehicle back could be very huge at some times. The following situations could let you incur more costs even though you have a comprehensive policy.

Towing

When your vehicle is involved in an accident, sometimes it might require towing to the garage where it would be repaired. Insurers only pay a reasonable amount for it to be towed to the nearest safe place. Their reasonability means, the cost of towing does not exceed normally 20% of the agreed repair bill. This means you can bear some costs for towing even though you have a comprehensive policy. Especially if the accident or crash happened on a highway and you have to tow to the nearest city or your city for a garage to assess the damage and repair.

Contribution

Indemnity means, to save from loss or harm. This is one of the basic principles of insurance. Insurance is a contract of indemnity because it is intended to provide financial compensation for a loss which the insured has suffered and place you back in the same or similar position after the loss as you enjoyed immediately before. This indemnity is an underlying principle for contribution in motor insurance. Insurance companies always pay for the cost of repairing or replacing the affected portion through insured peril. For instance, if an insured lose one driving mirror through a crush, the insurer would pay for the cost of one. It is possible the insured could not get a single mirror to buy but has to pay for pair. Some parts in the vehicle are pair and they are purchase always as a pair but insurers always pay for just the affected part.

When there is damage to part of the body of the vehicle which may require full spraying, insurers would only pay for the cost of the affected part. The insured has to contribute if they want to spray the entire vehicle.

Third-Party Property Damage

One component covered under the motor insurance policy is the damage the insured or the driver permitted by the insured to the driver could cause to properties belonging to other people with the vehicle. In simple terms, a driver could run into someone’s building, kiosks, shop, vehicle, building a wall, traffic light or any other property belonging to someone else other than the insured. The motor insurance covers the cost of replacing or reinstating the property but there is a limit which is normally around GHS 2,000.00 or GHS5, 000.00. Any amount that exceeds this would be paid by the insured himself. There was an instance when someone ran into another person’s vehicle and caused extensive damage. The vehicle got damaged beyond repair. The cost of the vehicle was around GHS90, 000.00. The third-party limit was just GHS2, 000.00. This means the one who caused the damage whether he has comprehensive insurance in place has to cough GHS88, 000.00. This was even higher than the cost of his vehicle. Where the insured thinks that the amount to cover damage to third party property damage is insufficient, he has the option of increasing the limit by paying an additional premium. The rate for the additional premium ranges between 1% – 2.5% on the additional amount or benefit one would like to add and this is based on the risk category or the use of the vehicle. Most people just buy the standard because they are not aware of these other benefits. Others who also know about this normally take the easy way out of not increasing their premiums and also think, the loss might not happen.

Excess

This is the first portion that would be borne by the insured when there is a claim. For private vehicles, the driver bears 10% of every loss. It is 15% for commercial and other vehicle types. This means that, if you are making a claim of GSHS100, 000.00 on a private vehicle, you stand to pay GHS10, 000.00 as the insurance company would pay 90% of the loss. This excess can be bought back but most people are not aware and some insurers are not willing to sell it. You can always talk to your insurers or brokers about this.

Personal Accident

Most policyholders or drivers are at risk. When there is an accident, the driver or the insured (who’s in charge of the vehicle) is not considered a third party and as such is not entitled to the third party benefit. The driver then benefits from the Personal Accident cover which is capped at GHS 2,000.00 / 5,000.00. There is no way this amount would ever be sufficient. The driver only becomes a third party when the accident was caused by another vehicle. The vehicle that caused the accident driver would also not benefit as a third party. The insured or the driver is exposed!

Emergency treatment

Insurers will pay the reasonable medical expenses incurred in connection with any bodily injury by violent accidental and external means sustained by you the driver or the insured and/or any occupants of your vehicle as to the direct result of an accident to your vehicle but such amount shall not exceed the authorized medical expenses limit shown in the schedule of the policy. The amount normally ranges from GHS40.00 – GHS60.00 per person. The period within which liability is admissible shall be 48 hours after an accident.

Contractual liability

The policy would also not cover any contractual liability that a policyholder may have towards the insured asset, that is, the vehicle. Contractual liability refers to any claim that may arise because of the policyholder entering into a contract with the same insured risk. For instance, the policyholder has pledged his car to someone (say against a loan) for a certain period and the car is damaged while being driven by the person to whom it has been pledged. Then any losses due to this damage won’t be covered.

Loss of use

This simply means that you will not be provided with a replacement vehicle or reimbursement for your transportation costs, while your vehicle is being repaired or replaced after being damaged by an insured peril. The policy would not pay for any cost you incur because your vehicle is going through repairs. Some companies have introduced hiring as optional benefits where insureds can hire similar vehicles when their vehicles are being repaired.

Market Value and Depreciation

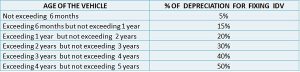

Whenever there is a total loss, insurers pay the market value of your vehicle or the sum insured whichever is less. This means, if you mistakenly insured the value of the vehicle below the actual value, you will end up not getting the actual money to replace your vehicle. When you insure the vehicle above the actual market value, insurers will pay for the actual market value. Insurers also depreciate the value of the vehicle when there is a total loss. There are a lot of different methods of depreciating the value of the vehicle to determine the actual value of the vehicle at the time of loss. Most insurers work with vehicle manufacturers chart like the one below:

Others also use the STC valuation data to determine the market value of vehicles at the time of accident. Below is one:

| Age | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| % | 10 | 15 | 25 | 30 | 40 | 50 | 60 | 70 | 70 | 80 |

But it’s funny how in Ghana now, the value of vehicles tends to appreciate. This means that you can sell vehicles after usage than even the amount you bought it.

Recommendation

Is there a way insurers can deal with contributions by insureds at the time of claim? Is it possible for actuaries to come out with a rate to charge at the inception of the policy so that policyholders do not contribute in any form at the time of a loss? I know most policyholders would welcome this idea.

Insureds incur other expenses when they have a claim. Is it possible for insurers to give an option for the insured to select a limit for out-of-pocket expenses? The limit could be from GHS1, 000.00 which the insured can claim up to with proof of receipts of incurred cost. This could cater for other expenses from towing, contribution, loss of use and other consequential losses.

The personal accident cover for drivers or insureds under the motor policy is limited and not enough. This is why it is so important to always educate drivers on the need to have a standalone Personal Accident policy that can give them a higher limit. With the standalone Personal Accident policy, the driver can take a higher limit by paying an additional premium.

Policyholders should be made more aware of their right to buy back the excess in the motor policy. Claims under the own damages section of policies, covering all classes of vehicles, are subject to a compulsory excess.

The third-party property damage limit in the motor policy is very small. The costs of claim are very high and it is necessary insureds should be made aware to increase their third-party property damage limit. Most people think because their sum insured is huge, the same applies to their third-party property damage.

There would be another school of thought who believe that when insurers cover everything, policyholders would not show reasonability when there is a loss. Again, policyholders can stage claim or deliberately cause damage. Others still believe that the importance of insurance is to provide peace of mind and when we don’t achieve this, then we have failed in everything else!

justice@jusbelriskconsult.com

Ref:

https://en.oxforddictionaries.com/definition/comprehensive

http://insurance-for-secure.blogspot.com/2012/01/history-of-motor-insurance.html

http://www.carinsurance.org/guide/history/