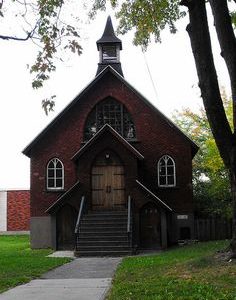

Letter to the CHURCHES in this era of Covid-19

Have people missed going to church or Pastors have missed their congregation? A church is a building used for public Christian worship – oxford dictionary. A church can also be a Christian religious organisation or congregation – Wikipedia. In the book of Revelation, Yehowa (Jehovah) told John to write what he was going to show […]

Read More »